Imagine waking up one day and realizing that you have become a millionaire! Well, this was a reality for many successful cryptocurrency investors. Before we jump into the finer details of crypto investments, let’s learn what cryptocurrencies are.

What Is A Cryptocurrency?

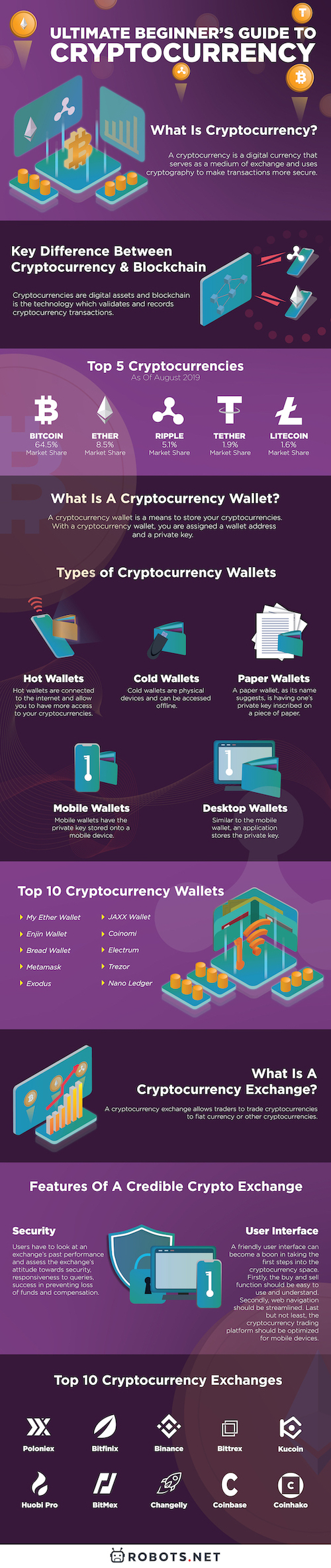

A cryptocurrency is a digital or virtual currency that serves as a medium of exchange and uses cryptography to make transactions more secure. Through the use of blockchain technology, crypto transactions are decentralized by nature, as compared to the centralized banking system that we are all familiar with. The cryptocurrencies market started with the inception of Bitcoin in January 2009. It was developed by an anonymous individual (or group) going by the alias “Satoshi Nakamoto”. Bitcoin was intended as a means to store and transfer value around the world without top-down control or a physical manifestation. This was in response to the 2008 financial crisis. 10 years later, in 2019, there are many cryptocurrencies created every day. However, almost all of them do not survive for long. As a result, lots of crypto investors have lost money from their investments. That is why it is crucial that cryptocurrency investors do their due diligence before investing in cryptocurrencies. For an in-depth explanation of the basics of cryptocurrency, check out our Crypto 101 guide here. Now, let’s talk about the various ways that you can profit from the cryptocurrency trend.

How To Profit From Cryptocurrency

There are a few ways to increase your net worth from cryptocurrency. The most obvious method is crypto trading. Besides that, you can also participate in ICO launches or mine cryptocurrency. While it may seem like a daunting process, investing in cryptocurrency is really simple! In this guide, we’ll introduce to you the top 5 cryptocurrencies to date, as well as the best cryptocurrency wallets and exchanges. But first, we have to talk about blockchain. Have you heard of the term before? If you’ve heard of cryptocurrency, I’m almost certain that you have heard of blockchain. But do you know that cryptocurrency and blockchain are completely different altogether? Yes, cryptocurrency and blockchain are often used interchangeably. But that isn’t factually accurate. Let’s learn what blockchain is all about.

What Is Blockchain?

Simply put, blockchain is the digital ledger that records cryptocurrency transactions. It is the platform that gives cryptocurrencies their decentralised and transparent features. Blockchain gets its name from being a “chain of transaction blocks”. In essence, it is nothing more than a digital financial ledger that is viewable by all involved stakeholders. Instead of keeping this financial database within a centralised authority (bank or government), it is stored digitally and distributed over many independent computer servers that are known as decentralized nodes. Every node will keep the same digital ledger. Moreover, each of these nodes confirms or rejects the validity of crypto transactions added to the ledger. The latest approved transactions are also reflected in every copy of the digital ledger in real-time. The distributed nature of blockchains makes it impossible for anyone, individual or entity, to control or manipulate ledger data. All other nodes will contradict and disavow any changes made to the ledger if a hacker had compromised a node or a node owner had malicious intent to it. For a detailed analysis of what is blockchain and how it works, you’ll want to read our comprehensive guide on Blockchain 101. Does it sound complicated? Not to worry! We’ll use 2 of the most popular blockchains to further illustrate how blockchain works.

Bitcore

Bitcore is the blockchain where Bitcoin transactions are recorded. As mentioned earlier, Bitcore is a public digital ledger where all Bitcoin transactions are viewable by account holders. These account holders function as network nodes that approve pending transactions. At least 51% of all network nodes have to compute that a transaction is valid before it is added to the blockchain. This is known as “proof of stake”. Here’s the kicker: the first network node to compute that the transaction is valid will receive a small amount of Bitcoin as reward. This is called “mining”. We’ll discuss more about Bitcoin mining later in the article. So, how does one become the first to validate a Bitcoin transaction? Well, the answer is simply to have superior computing power. Want to find out if Bitcoin is safe to invest in, check out our detailed analysis on the topic here.

Ethereum

First, we have to clear up a misconception. Ethereum is the blockchain platform which records Ether transactions. Yes, Ether is the actual name of the cryptocurrency, often referred to as Ethereum. Like Bitcore, Ethereum is also a public distributed ledger. However, it has an added smart contract functionality. In 2013, Ethereum’s founder, Vitalik Buterin, wrote in the Ethereum project’s white paper that Bitcoin was lacking scripting for automated contracts. Hence, the birth of Ethereum and the Ether cryptocurrency. Ethereum focuses on smart contracts and proof of work which is central to the cryptocurrency’s network. These smart contracts are a set of codes and protocols that makes up a trust-less system for executing predefined terms and conditions. In the traditional sense, numerous intermediaries, acting on behalf of the parties involved, drafted, executed, and enforced most contracts. These intermediaries can range from lawyers to bankers and represent a cost to the existing contractual procedure. Ethereum’s smart contract features reduces the need for third-party intermediaries, thereby lowering costs and time spent. For everything you need to know about Ethereum and Ether, click here to read our comprehensive guide.

Differences Between Cryptocurrency And Blockchain

Now that we know what cryptocurrencies and blockchain are, we can conclude that cryptocurrencies are digital assets and blockchain is the technology which validates and records these digital asset transactions. Blockchain serves as the platform which is needed for the facilitation of crypto transactions. These two terms go hand-in-hand but are really separate entities in the same ecosystem.

Top 5 Cryptocurrencies

We have all heard of Bitcoin and Ether(eum). But are there any other notable cryptocurrencies in the market as well? Let’s take a look at the top 5 cryptocurrencies as of July 2019.

1. Bitcoin — 64.5% market share

The leading cryptocurrency is obviously Bitcoin. The pioneer cryptocurrency was created in 2008 and currently holds 64.5% of the crypto market share. Given its top dog status since its inception, the alpha cryptocurrency is in no hurry to give up its market dominance any time soon. Why is that so? We believe that it has to do with Bitcoin’s proven track record for reliability over the decade. Also, people are considering BTC as a means of currency when the political or economic situation in their country is unstable. The first is in Argentina, where the situation with peso became so uncertain that many people started to invest in Bitcoin. This has seen Bitcoin’s price grow within the region. The second is happening in Hong Kong. The political situation in 2019 has encouraged people to hold on to Bitcoin. These examples prove that Bitcoin has become a reliable asset of investments and a lifebuoy in extreme situations.

2. Ether — 8.5% market share

The second most dominant cryptocurrency is Ether. As mentioned earlier, Ethereum has developed an innovative decentralized applications (dApps) platform. It is also the first blockchain system to apply smart contracts during transactions. Ether’s strong utility makes it a viable investment option for investors. Since early 2016, Ethereum has made significant gains raising to heights of over a thousand USD by early 2018. For any individual looking at Ethereum as a good investment, this growth rate is certainly enticing. The use of Ether is not only used to power other blockchain applications being built on the Ethereum blockchain but also as a means to raise funds. People looking to participate in ICOs could use Ether. This is one of the contributing factors to Ethereum’s past market performance.

3. Ripple — 5.1% market share

Coming in at number 3, we have Ripple. An asset of Ripple Consensus Ledger, Ripple is considered to be the most efficient choice for the financial sphere and liquidity providers because it enables the fastest transaction verification. This cryptocurrency has six years of trading history, first appearing on the market on the fifth of August 2013 at approximately $0.005. Since then, it has experienced tremendous growth reaching $3.84 on the fourth of January, 2018. That’s an ROI of 768 times! With numbers like these, it is easy to see why this cryptocurrency is popular among investors.

4. Tether — 1.9% market share

Classed as a “stable coin”, Tether has its value fixed to the U.S. dollar. Tether was designed to take on the price volatility that the cryptocurrency market is infamous for. While you might wake up one day to realise that the value of your holding cryptocurrencies have dropped drastically, you’ll be safe in the knowledge that Tether hovers around the pricing of the U.S. dollar. Why is this beneficial? By having their value collateralized, stable coins such as Tether aims to eliminate the confusion around conversion rates, thus making the stable coin more practical for both users and merchants. Secondly, Tether gives people a familiar currency to enter the cryptocurrency market with. Most importantly, it provides investors with the option to safeguard their crypto net worth by converting other cryptocurrencies into Tether. Curious to know about Tether and its “stable coin” functionalities? Read our detailed guide here.

5. Litecoin — 1.6% market share

Litecoin is a cryptocurrency built by Charlie Lee. Today, it occupies the fifth position in the world of cryptocurrencies. Litecoin was formed on Bitcoin’s protocol but it differs as it applies another hashing algorithm. Today, Litecoin is positioning itself as a cryptocurrency for payments. A Litecoin investment is a passive one — you should hold it until it increases in value. Still unsure on which cryptocurrency to invest in? Click here for the undisputed top 10 cryptocurrencies to buy in 2019!

Differences Among The Top 3 Cryptocurrencies

As we just learnt, Bitcoin, Ether and Ripple account for a combined total of 78.1% of the entire crypto market share. These 3 cryptocurrencies are among the most commonly invested cryptocurrencies in the world. However, there are key differences to each cryptocurrency’s application(s) and utility value. Let’s find out what they are.

Ethereum Vs Bitcoin

Bitcoin and Ethereum utilize very similar technologies. But, their use cases are quite different.

Utility Differences Between Bitcoin and Ethereum

For starters, Bitcoin is a general-purpose cryptocurrency. While it can do some limited scripting, it was meant as a replacement of fiat currencies. And it performs the same functions as traditional money. This means that you can use Bitcoin as a store of value just like any traditional currency. In addition, you can also use it as an investment, with the added benefit that no one will know how much you own. Furthermore, you can use Bitcoin to make payments. It is especially adept for cross-border payments, given that the intermediary fee is considerably lower than traditional finanical services such as Western Union. Ethereum, on the other hand, was designed specifically for running decentralized applications. While you certainly can use it as a store of value, an investment and a means of making payments, it is much more than that. It allows companies to build basic crypto applications and execute smart contracts, providing a tangible value beyond transactions. In summary, if Bitcoin were to disappear tomorrow, many crypto investors would lose significant sums of money. But if Ethereum were to disappear, it would far more adversely affect the world.

Technical Differences Between Bitcoin And Ethereum

There are also technical differences between Bitcoin and Ethereum. First, transaction speed. Bitcore is able to process up to 7 transactions per second. On the other hand, Ethereum is much faster as it is capable of processing up to 20 transactions per second. Second, the max supply of Bitcoin is capped at 21 million BTCs. However, Ether’s supply is theoretically limitless. Experts have commented that this could hugely affect the valuation of these two cryptocurrencies in the future. For a detailed outlook on Ethereum vs Bitcoin, read our previous article here.

Ripple Vs Bitcoin

The ownership models of Bitcoin and Ripple represents arguably the biggest difference between the two cryptocurrencies.

Ownership Model

When the Bitcoin network was first conceptualized, it was done so with the ideology for decentralized transactions. Bitcoin was a means to ensure that no one could monopolize the store of value, tamper with the transfer of funds or alter information through validation and transparency. No single entity governs the Bitcoin network and participation is available to all. Ripple, on the other hand, is high centralised and owned by its parent company (also known as Ripple). Participants of the Ripple network are elected. While the network can function autonomously, the company cannot. It must operate within the boundaries set by the countries it is operating in and adapt to meet the needs of its clients. This would mean that Ripple’s management can easily influence the way the Ripple network operates. All in all, this has caused much controversy in the crypto world as Ripple is perpetrating the very flaws of the traditional financial system that Bitcoin aims to do away with.

Technology

The decentralized nature of the Bitcoin network allows for its code to be open-sourced. As a result, other blockchain projects can be developed from its concept. The rise of Bitcoin Cash is one famous example. Holders of Bitcoin on a supported wallet would also have received Bitcoin Cash. The Ripple network, on the other hand, is unlikely to have sudden forks as the direction of the network is determined by its management. Instead of a decentralized open-sourced solution that can be adapted, Ripple is presented as a suite of solutions to key problems faced by entities to process payment and source for liquidity.

Transaction Speed

Another major technological difference between Bitcoin and Ripple is transaction speed. Bitcoin transactions can take up to 30 minutes or more to clear and settle while Ripple takes under five seconds. This is due to the Bitcoin network’s Proof of Work system that takes time for block confirmations. Ripple’s validators, on the other hand, are centralized and transactions need only be verified by the list of approved unique nodes.

Application

The main difference between Ripple and Bitcoin’s application lies in Bitcoin’s ability to assume the roles of both commodity and currency, while Ripple is only designed to function as a currency. Furthermore, Bitcoin’s decentralized nature means that it is very difficult to shut down. Its value may depreciate, but its existence will remain as long as people are willing to run the Bitcoin nodes.

Tokenomics

With a limited token supply of only 21 million, bitcoin’s scarcity has caused its price to surge in recent years due to demand from speculation and usage. Ripple, on the other hand, has approximately 60% of its total token supply locked in an escrow, to be periodically released into the market. This has a “de-inflatory” effect as Ripple’s management can exert some measure of control over the market. For a detailed outlook on Ripple vs Bitcoin, read our previous article here.

Ripple Vs Ethereum

When it comes to a debate between Ripple and Ethereum, their differences begin with their ideology right through to their utility and technological architecture.

Governance

For starters, Ripple is centralised in its management. This means that, while anyone can use Ripple, the company’s management team determines the direction of the Ripple network. Ethereum, on the other hand, requires decentralization to function. Under the Ethereum network’s proof of work system, after successfully mining a block of a transaction, participants receive Ether. The transparency of transactions and decentralized nature of Ethereum prevent a single point of failure or control.

Application

The second major difference between Ripple and Ethereum is their applications and uses. Ripple is for financial institutions to use to improve their operations. The Ripple network and its native token XRP facilitates both the transfer of value and the exchange of value from one currency to another. Ether is used as a store of value, medium of exchange, and represents a unit of account. Furthermore, Ethereum’s platform allows the building of other blockchain applications in it. Ether exists as a product of the proof of work system and an incentive.

Ownership

Third, difference in token ownership. Certain individuals and entities hold ownership of Ripple. At one point, 60% of XRPs supply is in an escrow. These tokens are then slowly released into the market periodically. For Ether, the Ethereum foundation does not concentratedly hold Ethereum’s token supply. The concentration of tokens is crucial to each network. This is because a mass token sell-off will crash the price and affect the health of the network’s economics.

Transaction Speed

The transaction speed of a blockchain network is a major factor for its utility. Currently, Ethereum can process up to 20 transactions per second. Ripple, on the other hand, is much faster at 1,500 transactions per second. This means that payments made using the Ripple network can settle in about four seconds. Considering that, it is clear to see that Ripple has greater utility as a transaction token as compared to Ether. For a detailed outlook on Ripple vs Ethereum, read our previous article here.

What Is A Cryptocurrency Wallet?

Now that you know all about the top cryptocurrencies in the world, what’s next? You’ll need a means to store the cryptocurrencies that you have just purchased. Keeping your funds safe is the most important concept when it comes to crypto investments. The way to keep your crypto assets safe and secure is to use a credible cryptocurrency wallet. With a cryptocurrency wallet, you are assigned a wallet address and a private key. Only those with the private key have access to what and how many cryptocurrency tokens the wallet hold. Thus, once your private key is compromised by a bad actor, it is as good as giving away your crypto funds. So, it is important that you choose the right type of cryptocurrency wallet for your needs.

Types Of Cryptocurrency Wallets

In general, there are 5 types of cryptocurrency wallets. In this section, we will discuss in depth the features of each wallet type and who is most suitable to use each type.

Hot Wallets

Hot wallets are connected to the internet and allow you to have more access to your cryptocurrency funds for transactions. On the flip side, this added accessibility comes at a cost of security when you connect to the internet. It exposes not only your device but also the private keys.

Cold Wallets

Cold wallets can be accessed offline. The private keys are stored inside a physical device. Moreover, any transactions are signed within it. After which, the result of the interaction will be sent outwards. This process is time-consuming as any transaction requires you to pull out the device. However, it is also the safest as the private key does not leave the device, not even to the computer used to access the device.

Paper Wallets

Paper wallets, as their name suggests, is having the private keys inscribed on a piece of paper. This can be the best crypto wallet to store the private keys and by extension, the cryptocurrency funds, if certain conditions are met. Firstly, the computer or device must be secured when the private key is initially accessed. Secondly, the paper itself is not lost or damaged such that the private keys are no longer legible. Lastly, the private keys are never seen by other parties online or otherwise. Paper wallets are safe as the private keys are stored offline, but there is always the risk of losing that piece of paper through accidents or theft. Accessibility can also be an issue as the piece of paper needs to be taken out every time the private keys are required.

Mobile Wallets

Mobile wallets have the private keys stored onto a mobile device. The main appeal to this method of storage is the great ease and convenience in accessing the cryptocurrency funds. While it might not be the best blockchain wallet, it is the most compatible to use as the mobile interface is familiar to most users today. The practical application of a mobile wallet would involve the storage of a smaller amount of funds or funds that are expected to be moved frequently.

Desktop Wallets

Similar to the mobile wallet, an application stores the private key. A desktop wallet not only brings greater ease but also presents a greater risk than a mobile wallet. The activity that takes place on the device and frequent connection to the internet presents a huge risk in breach of security. Hackers can deploy phishing tactics and other means to acquire access to the device and thereby mine the tokens.

Top 10 Cryptocurrency Wallets

1. My Ether Wallet

My Ether Wallet is an initiative developed by an organization of cryptocurrency enthusiast as a wallet client for ERC-20 tokens. These are tokens developed from the Ethereum network. With a My Ether Wallet, you can create an Ether wallet on its website, which allows you to interact with the Ethereum blockchain. Some will consider it as the best blockchain wallet because of the fast set up and ease of use. However, it is not the best bitcoin wallet as bitcoin is not an ERC-20 token. This limitation to Ethereum based tokens reduces its compatibility, which in turn reduces convenience for users with a larger range of cryptocurrency holdings. Support can be difficult to acquire, especially in the case of a lost password. As such, users must take greater proactivity for safekeeping their cryptocurrency.

2. Enjin Wallet

Currently, available for both IOS and Android, Enjin is developed by Enjin Pte. Ltd. in Singapore as a mobile wallet for cryptocurrencies. It is a contender for the best crypto wallet for mobile application as it not only upholds privacy ethics but also adds security features such as two-level encryption. Enjin makes it to the article’s top ten list as the best crypto wallet as it can combine high security with user experience. Its two-level encryption uses two separate layers of cryptography while its intuitive interface enables users to access details of transactions, block screenshots and is compatible with not only ERC-20 tokens but also bitcoin, Litecoin, etc.

3. Bread Wallet

Bread is a venture-backed company providing a decentralized wallet. This means that there are no accounts or server to hack. Users can access this blockchain wallet and connect to the network via a twelve-word key. It is compatible with both bitcoin and ERC-20 tokens, making it very convenient for users to store multiple types of cryptocurrency using the same interface. The crypto wallet is designed for beginners with an easy to use interface and an extensive knowledge bank. Bread makes it to the top ten list for the best crypto wallet as it differentiates itself through the availability of support and its decision to support the community by making its core wallet technology free and open-source.

4. Metamask

Metamask is an Ethereum based web wallet that allows the user to connect to the Ethereum blockchain. It has extensions into different web browsers with a built-in exchange, thereby giving it greater convenience for users. Being a decentralized application, it is multilingual supported to cater to a varied global audience. A key feature to note is Metamask’s categorization as an HD wallet which relies on the single seed generated during initial set up. Since there is no customer support, users have to be more proactive and diligent in storing the required information. While it can contest as the best crypto wallet for web browsers, it is unfortunately not the best bitcoin wallet as Metamask does not support bitcoin.

5. Exodus

Exodus wallet’s versatility is its greatest strength. Founded in 2015, it has a statement to empower people to control their wealth. This wallet has the most range in user experience as it can be a desktop wallet, mobile wallet, and compatible with the hardware wallet Trezor. Currently, it is compatible with 105 different kinds of cryptocurrency, including Bitcoin. It makes it to the list of the best crypto wallet as it has decent interface compatibility, coupled with responsive support and the ability to provide crypto exchange services.

6. JAXX Wallet

JAXX wallet is a contender for the best mobile wallet as it applies to Bitcoin, Ethereum, and 80 other cryptocurrencies. Besides being free, its cross-platform ability is the wallet’s main differentiating feature. It also contains an exchange for supported digital assets, portfolio management to track each cryptocurrency’s performance, market data display, and a news feed. This convenience is combined with customer support and the ability to monitor transactional data.

7. Coinomi

Coinomi is a desktop and mobile wallet with a broad range of over 1,500 blockchain assets. That makes it one of the best blockchain wallets. Coinomi has certain distinct features, most notably its emphasis on anonymity. It allows users to anonymize the IP address as well as eliminating the bureaucratic KYC process. Also, it provides support and is readable in over 25 different languages. That makes Coinomi’s adoption practical for many around the globe. Besides being a wallet for cryptocurrencies, Coinomi has a partnership with entities such as shapeshift and change to enable cryptocurrency exchange functions for supported digital assets. Another versatile wallet, Coinomi certainly has a place among the best crypto wallet of 2019.

8. Electrum

For cryptocurrency veterans, Electrum might be a familiar name. Created in November 2011 by Thomas Voegtlin, Electrum is a Bitcoin wallet with a long 8-year history. Since then, various contributing developers has been working on its source code. As a decentralized wallet for desktop and mobile devices, Electrum will never experience downtime. Moreover, it gives the user greater control over their private keys. In the case of accidents, there is a secret phrase for each user to recover their funds, making the wallet slightly more forgiving towards mishaps. Using your desktop or mobile wallet as a form of cold storage for the private keys does have its risks as mentioned in the earlier sections. However, Electrum still takes a spot in this list of top 10 best cryptocurrency wallet as its utility has endured the test of time.

9. Trezor

By SatoshiLabs, Trezor is a cold wallet for Bitcoin, Ethereum, and over 1000 other supported cryptocurrencies. Being a cold wallet, the private keys never leave the device. It is one of the most secure cryptocurrency wallets in the market. Trezor has extensive customer support. It has the option to back up the device with a 24-word recovery seed. Somehow, it is slightly inconvenient for users who frequently transfer funds. However, the level of security it provides is well worth it.

10. Nano Ledger

Nano Ledger provides secure offline storage for your private keys. It can be the product rival of the Trezor with a range of cold wallet devices at different degrees of capability. As with Trezor, all Nano Ledger devices have the option to set a string of recovery seeds in the event the device becomes lost or damaged. Users choosing between the Trezor and Nano Ledger will likely be considering the price factor and capabilities required for its intended use. For an in-depth explanation on types of crypto wallets and the best ones to use in 2019, check out our guide here.

What Is A Cryptocurrency Exchange?

In the early days of the cryptocurrency market, there were not a lot of reliable trading platforms to choose from. It was a murky and uncertain environment. Transactions cannot be reversed and a legal case was hard to establish. As a result, a party acting maliciously faces little to no recourse. Currently, the cryptocurrency industry has been making huge progress. Gone were the days where buying and selling cryptocurrency resemble shady back-alley deals. There are now digital currency exchanges that offer more than the typical bitcoin trading platform.

Features Of A Credible Cryptocurrency Exchange

Out of all the cryptocurrency trading platforms available, some have distinguished themselves as top players in their field. In this section, we will go through some factors to conciser when choosing a cryptocurrency exchange as well as a list of top crypto exchanges.

Security

Back around 2011, the unthinkable happened. Mt Gox, then the largest bitcoin trading platform was hacked. Despite the lawsuits and demands for bitcoin from victims of the exchange, it is unclear how they will be compensated for their loss. From this infamous case, it is clear that safety is of the utmost importance when looking at a cryptocurrency trading platform. To identify a credible cryptocurrency exchange, it is important to assess the exchange’s attitude towards security, responsiveness to queries, success in preventing loss of funds and compensation. On a positive note, the cryptocurrency sector has identified best security practices. Cryptocurrencies are now more commonly stored in cold wallets rather than hot wallets that are accessible online. In the event of a successful hack, only a portion of the total funds is lost through the hot wallet. Thus, users have to look at an exchange’s past performance and only select cryptocurrency trading platforms that the user deems reputable. If unsure, a user can choose to keep cryptocurrency funds in a cold wallet that they owned.

User Interface

With the steep learning curve of cryptocurrencies, a friendly user interface can become a boon in taking the first few steps into the cryptocurrency space. Functions such as one-click trading will speed up the process and create a hassle-free experience. Firstly, the buy and sell function should be easy to use and understand. This extends to the trading rules around trading fees, withdrawals and setting up different types of orders. Besides buying and selling, some exchanges allow users to set up trailing stop losses and stop-limit orders. Secondly, web navigation should be streamlined. With the depth of some websites, it can be daunting to find the relevant page or information on a cryptocurrency trading platform. Poorly organized websites with numerous layers and pages make it more complicated for new users. Thirdly, is the mobile optimization of the exchange on the web. If a mobile application for the exchange has not been developed, then it is advantageous to have the cryptocurrency trading platform optimized for mobile devices. Being mobile-optimized will create greater convenience as users tend to have smartphones in this day and age. Lastly, the cryptocurrency trading platform should be responsive toward inquiries. This will reduce frustration, especially when unexpected incidents happen.

Trading Platform Markets

With each cryptocurrency exchange, there exist different markets for a particular token or coin. This is especially important as different individuals are trading with different goals in mind. For example, if a user has XRP and wishes to trade for USDT, then that individual would have to trade XRP on the USDT market under the XRP/USDT pair. If an exchange does not have the market a user wishes to trade on, then perhaps it is best to look for an alternative cryptocurrency trading platform. The common markets than can be found on cryptocurrency trading exchanges, in general, are the BTC, ETH, USDT and USD markets. Therefore, it is wise to consider checking out the markets available on a cryptocurrency trading platform and the trading volume before deciding where to transfer, buy or sell cryptocurrencies. Fortunately, the information is usually available on the main page of the exchange itself. Thus, users need not sign up for the exchange and commit before being allowed to look at the markets and their volume.

Top 10 Cryptocurrency Exchanges

Let’s move on to a list of the top cryptocurrency trading platforms. Each user will have a different opinion on what constitutes the best cryptocurrency trading platform. Hence, each of the listed exchanges in this section will have different features that set them apart from others.

1. Poloniex

A player in the market since the early days of 2014, Poloniex has certainly proved its position in the industry. Since then, the trading platform has expended its cryptocurrency offerings beyond major coins such as bitcoin and Ethereum. Users can now trade from over 60 different altcoins, thereby providing access to a greater range of cryptocurrencies under a single exchange. In addition, the exchange has added features such as margin trading and smart APIs to cater to a wider range of users.

2. Bitfinix

This cryptocurrency trading platform has trading features beyond what many other trading platforms offer. It offers trailing stop losses, kill or fill, one cancel other, among other trading functionality. This is highly advantageous for users who are looking to make frequent trades. These features add a certain level of automation to the standard buy and sell orders. In addition, the exchange allows for margin trading and margin funding.

3. Binance

Binance is a highly reputable crypto trading platform. It allows users to trade within different markets ranging from bitcoin and Ethereum to various stable coin markets such as USDT. The cryptocurrency trading platform has used more complex buying and selling orders to suit the needs of different traders. Moreover, Binance does upgrade their platform and services.

4. Bittrex

This cryptocurrency trading exchange is also one with a longer history of operation making it a veteran in the market. It offers the trading option most reputable exchanges do and has started launching its own IEO on the platform. While its fees are not the cheapest, it is still at the lower range than some of the cryptocurrency exchange platform on the market.

5. Kucoin

Aesthetically the most appealing, this cryptocurrency exchange platform brings a new trading experience with its sleek design and interface. It has the trading options that most competitors have in the market. In addition, safety built into its trading user interface. To add on to user security, Kucoin uses 2FA authentication that can be enabled before access is granted. A more pleasantly designed exchange, it will likely provide a unique user experience.

6. Huobi Pro

As a cryptocurrency trading platform, it offers numerous tokens to trade and markets to trade from. Another big exchange with a long history of operation, it has served users well and withstood the test of time. In recent times, the cryptocurrency trading platform has implemented its own mobile application to keep up with consumer behavior. In addition, the exchange is very customer-centric with options such as 24/7 customer support.

7. BitMex

A leverage-focused cryptocurrency trading platform, BitMex allows for up to 100 times leverage on bitcoin contracts. In addition, BitMex has thus far suffered no successful hacking or intrusions. Coupled with a highly liquid market, BitMex is a cryptocurrency trading platform that tends to appeal to users who likely trade at a higher frequency and volume.

8. Changelly

Operating since 2015, Changelly is a unique cryptocurrency trading platform where the platform acts as an intermediary between cryptocurrency exchanges and users. It has a mobile application for users and features comprehensive 24/7 live support, making the cryptocurrency platform friendly to newcomers. As a non-custodian instant cryptocurrency exchange, it does present itself as an alternative to users who are looking at the cryptocurrency market.

9. Coinbase

Coinbase is a popular exchange with a track record of being reliable. As a crypto-to-fiat exchange, Coinbase has a strict token listing process to provide users with the best experience possible. This stringent vetting process helps to eliminate cryptocurrency that is of lower quality and reduces user’s exposure to them. As an entry to buy bitcoin and other major cryptocurrencies such as Ethereum. Coinbase has become a familiar name in the cryptocurrency space. While having a limited number of tokens listed on the exchange and higher fees, the platform has a long history of operation given the relative age of the cryptocurrency market in general. As such, Coinbase is worth a spot as part of the consideration set for the best cryptocurrency trading platform.

10. Coinhako

Serving the South East Asia region, Coinhako is another fiat-to-crypto exchange to consider if the user is from the specified geographic region. The exchange is a gateway to cryptocurrencies as it allows an individual to purchase cryptocurrency using fiat. While having more tokens listed on the exchange, its fees are still higher than some exchanges. The exchange stands out in its offers and promotions which can help save fees for users. As an exchange, it is certainly intuitive with its simplistic and practical design. Coupled with updates on token listings and trading promotions, this is certainly a cryptocurrency trading platform to look out for. It is often used as a benchmark to gauge relevant cryptocurrency trading platforms. For everything you need to know about crypto exchanges, read our previous guide here.

What Is Cryptocurrency Mining?

The idea of cryptocurrency mining paints a lucrative picture. Imagine having a couple of computers and hardware sitting somewhere in the house, generating passive income in the form of a digital asset. The potential rewards can spur some people into becoming cryptocurrency miners. In many ways, those who mine cryptocurrencies are similar to the people who once mined for gold in places such as Alaska. However, instead of seeking their fortune by mining precious metals found in the ground, they mine for digital gold. They do this by solving a puzzle through the use of powerful computer systems. Likewise, miners can exchange cryptocurrency that they have mined for any traditional currency they would like. Today, the mining game has gotten more competitive. Anyone can set up a rig and start mining cryptocurrency. However, turning a profit would mean competing with established players who have been in the game for years already. Having said that, let’s find out how to mine Bitcoin and Ethereum!

How To Mine Bitcoin

Semantically speaking, it is not correct to call what Bitcoin miners do “mining.” Unlike those who mine for precious metals, Bitcoin miners do not mine for anything. Instead, in exchange for receiving Bitcoins as a reward, they perform a computational task. This task is called a proof of work (PoW). To receive the Bitcoin bounty, miners must be the first to confirm 1MB of Bitcoin transactions. This is done by getting their computer systems to solve a cryptographic puzzle. In essence, all Bitcoin miners are racing against each other to solve this puzzle. This entails finding a 64-bit number called a hash. Each miner uses the same algorithm to find the winning hash. This means that the only way to have an advantage over other miners is to add computational power when searching for the hash.

Equipment Needed To Mine Bitcoin

There are two different ways on how you can mine Bitcoin. You can attempt to mine it yourself, or you can join what is called a Bitcoin mining pool. In either case, you will have to buy or build what is commonly known as a mining rig. A mining rig is a computer that has been specifically designed to mine Bitcoins or other types of altcoins such as Ethereum. You cannot use this computer for normal tasks, such as running Windows or a browser. It can do one thing alone: find hashes. Mining rigs are graded by the number of hashes they can generate in a second. The higher the value, the better. When purchasing a rig (or building your own), the only thing that matters is how many hashes it can generate in a second. Another thing that affects profitability is the cost of electricity, as rigs use a lot of it. This is why Bitcoin mining often occurs in places where electricity costs are low. For everything you need to know about mining Bitcoin, check out our previous article right here.

How To Mine Ethereum

Mining is a way to generate Ether without a central issuer. It gives Ethereum a scalable token supply. During the mining of Ethereum, there’s a need to solve complex mathematical problems to verify transactions on the blockchain. This process of mining that makes record-keeping on the blockchain possible. This, in turn, supports Ethereum’s trust-less system. At the start of the mining process, miners use computers to solve complex puzzles until one of them wins the right to the next block of transaction. Next, the miners will run the block’s unique header metadata through a hash function with only changed nonce value. Through computer programs, the miner will find the hash that matches a target. After that, he will receive Ether. Moreover, broadcasting the block of transaction across the network is needed for each node to validate. These miners randomly earn Ether. Their profitability depends on luck and computing power. In about twelve to fifteen seconds, a miner finds a block. If the rate is too fast or slow, the Ethereum networks algorithm will re-adjust the difficulty. This way, the rate at which each block is verified returns to about 12 seconds.

Equipment Needed To Mine Ethereum

Anyone can mine Ethereum. However, in the race for mining supremacy, it is harder and harder to turn a profit with low powered set up such as your home computer. This is especially true when mining on major blockchains such as Ethereum. The reason is, more people are willing to invest in the latest and most powerful hardware. Moreover, unlike Bitcoin mining, expensive ASICs, which are essentially specialized mining chips, cannot be used in Ethereum mining. This is a result of Ethereum’s proof of work algorithm Ethash. It is designed to require more memory, thereby making ASICs harder to use in mining Ethereum. Currently, GPU is the only viable option for Ether Miner. Its cost ranges from $500 – $1000. AMDRX 580/570 and Nividia GTX 1070 are examples of these GPUs. After you have set up the mining hardware, you will need to install the software needed to connect your node to the rest of the Ethereum network. This software provides you with the ability to deploy your smart contracts and send transactions using command lines. For everything you need to know about mining Ethereum, check out our previous guide right here.

How To Create A Cryptocurrency

A well-researched person on the subject would no doubt have heard of successes like Bitcoin and Ethereum. He or she might also be tempted to create their own cryptocurrency to ride on the trend. Well, you’ll be glad to know that anyone can create a cryptocurrency. Let’s see how it is done!

Build On Ethereum

During the ICO craze back in 2017, there were a lot of cryptocurrencies launched on Ethereum. Ethereum is a decentralized application platform that allows the building of other applications on its network. Projects being developed on the Ethereum network are ERC-20 tokens. They require Ethereum’s native token, Ether, to power. Being an ERC-20 token and built on Ethereum subjects, the newly created cryptocurrency has its advantages. Creating a cryptocurrency on Ethereum will make it compatible with wallets that allow for ERC-20 tokens. Also, there is a large community around Ethereum, the second-largest cryptocurrency by market capacity. Thus, the newly created cryptocurrency will have an established ecosystem around it when building on the Ethereum network.

Launch Your Cryptocurrency Project Through An Initial Coin Offering (ICO)

Initial coin offerings, or ICOs, are fundraising activities that start-ups use to garner the support and the capital needed to develop their technological innovations. It has nowadays been regarded as crowdfunding, the creation of a digital asset. To ensure the success of your ICO, you will need to follow these best practices.

Credible Management & Technical Team

The team behind the cryptocurrency project can inspire confidence among investors. Having experts within each area of the business is a sign of professional management of the project. It is better than having a team of fresh individuals. While having an inexperienced team is not a red flag, it is in the project’s best interest to get the best people for the right job to increase the success rate.

Comprehensive White Paper

Your cryptocurrency project’s white paper must detail the problem statement, value proposition, points of differentiation, technology innovation, development roadmap, and team description, among other relevant information to the project. Having a vague and poorly written white paper is a warning sign for many potential investors. Moreover, grammatical errors, copied information, and vague project description are all sloppy writing. They can hinder the traction of a promising project.

Solid Post-ICO Road Map

This must involve activities such as bounties for bugs, translation, etc. Community management is also an essential function after the launch of the cryptocurrency to address the queries of the public and stakeholders.

Final Thoughts On Launching An ICO

The hype that the media gives highly romanticized the idea of launching a cryptocurrency. In reality, it involves complex ideas and foresight that have to work in synchronization with operations to turn it into a sustainable project in the long run. Want to learn more about how to create a cryptocurrency? Our one-stop detailed guide is right here.

Predictions On The Future Of Cryptocurrency

The future of cryptocurrency is heavily dependent on real-world applications. Most, if not all, noteworthy cryptocurrency projects are developing a solution to solve a real-world problem. If these solutions come into fruition, the potential will fill the future. If you’re curious as to whether it is worthwhile to start investing in cryptocurrencies, have a look at the top 10 cryptocurrency predictions for 2019.

1. Bitcoin Will Surpass US$1M

Launched in 2009 into the market, Bitcoin has grown exponentially. It has reached nearly $20,000 per bitcoin at its all-time high. With astronomical growths likes this, many Bitcoin maximalists believe that Bitcoin can reach 1 million dollars and beyond. But is it a realistic figure? Well, to Bitcoin purists, this is certainly a possible prediction for the cryptocurrency if demand for bitcoin increases.

2. Altcoins Will Boom

Altcoins are any cryptocurrency that is not Bitcoin. Speculators believe that when Bitcoin decrease in dominance, more capital in the market will be allocated to altcoins. This will cause them to rise exponentially in value. Given the newness of the market, most of the cryptocurrency projects are currently still in development. Some are establishing themselves. As such, many of these cryptocurrency projects and their tokens ran the risk of failure. There have already been reports of exit scams and missed deadlines. If the cryptocurrency prediction of an altcoin boom is to happen, these projects have to quickly develop their solution and find their purpose. On a positive note, some of these projects have already started to see if the use cases and the ideas that they are trying to develop have high potential returns. Some of these bold ideas include micro-insurance, gaming tokens, and privacy coins just to name a few.

3. Banking And Financial Institutions Will Be Disrupted

Cryptocurrency such as bitcoin allows for peer to peer transactions and storage of one’s fund without an intermediary. The revolutionary function of some cryptocurrency will allow people to cut out the middleman. The current banking and financial infrastructure have inefficiencies that have yet to be solved. These include high fees for cross border transfer of funds and lag time for the actual fund transfer. Cryptocurrencies could eliminate these problems with blockchain solutions such as distributed ledger technology, transparency, pseudonymity, and smart contracts. The potential for future cryptocurrency and blockchain solutions to disrupt banking and financial institutions is there. However, it is still a long road of development.

4. Complementing The Internet of Things (IoT) Market

With the rapid growth of technology, more and more common items have become tied with digital interfaces. This increased digitization of items has been speculated to give rise to an internet of things where devices are connected and able to share data amongst each other. The outcome of such an event would be an increasingly efficient system where more and more of our lives become automated. The technology binding these devices together require scalability as more and more data is stored and analyzed. It is predicted that the role cryptocurrencies play in the IoT era would be enhanced efficiency at a lower cost.

5. Governments Might Use Cryptocurrencies

Governments are still developing regulations around cryptocurrency and their classification. However, there has been speculation that the governments might adopt the future of cryptocurrency. Venezuela has made news regarding its petrol token and Libra have been a contested topic for some time now. It seems that while cryptocurrency is still in a grey area, it has seen an increase in interest from institutions and authorities. There have also been theories on the usage of cryptocurrency for economically weaker countries who suffer from hyperinflation and political unrest. Their citizens can, in theory, opt for digital assets such as bitcoin to serve as a heaven for storing their value. Greece’s debt crisis is a real-world scenario where the application and adoption of cryptocurrency can be viable. For now, the cryptocurrency markets are still in the introductory stage, and many laws around them are still undefined. Only time will reveal the outcome of this cryptocurrency prediction and where the future of cryptocurrency will lie.

6. Ethereum Will Rise To US$100K

An Ether price of $100,000 is a subject of wild speculation as no one can truly predict the forces of supply and demand in the market. However, there might be some truths in these speculations, as in theory, a higher rate of demand to supply will lead to an increase in price. Moreover, the Ethereum project has a proven track record of success thus far. If Ethereum’s network receives more adoption, the demand for ether will increase. This will then, in theory, subsequently drive up its price.

7. Institutions Will Enter The Market

This is an interesting cryptocurrency prediction as it points out that heavy institutional participation will be the cause of a rise in market capacity for the cryptocurrency market. Since the beginnings of cryptocurrency stem from a detachment of institutions, a larger market capacity from institutional participation will seem ironic. Nevertheless, institutional interest will, in theory, help build the cryptocurrency market as they will bring in large clients and investors with them. This is one such reason why a bitcoin ETF is drawing a lot of hype and speculation.

8. Ripple Will Become The New Bitcoin

Ripple is designed to be used with the existing financial infrastructure, making it more efficient instead of disrupting it. Unlike other cryptocurrencies, it does not have mining, proof of work, or proof of stake. In place, it has a validator system with a pre-mined supply of tokens. If successful, the cryptocurrency’s future will have potential as institutional demand will far outweigh public participation. Speculators predict that this cryptocurrency will have a higher chance of adoption. This is because it is run by a company thereby reducing the risk of community sentiment changing the direction of the company as with the case of hard forks.

9. Combined Crypto Market Cap To Exceed US$40T

The future of cryptocurrency with a market capacity of 40 trillion dollars will require substantial growth from its current state. The factors that will lead to such a dramatic increase will be adopted through actual utility and mass speculation. The sustainability of a rapid rise is questionable, but given the past performance of the market since its introduction, it is definitely in the realms of possibility.

10. The Gaming Industry Will Accept Cryptocurrencies As Payment

The gaming sector has already been using virtual currencies for in-game purchases. Given the acceptance of blockchain from gaming audiences, people are speculating that the gaming sector can become the catalyst for ushering in the future of cryptocurrency. There have already been blockchain games developed such as crypto kitties developed on the Ethereum network and cryptocurrency projects dedicated to gaming such as Enjin.

Final Thoughts On Cryptocurrencies In 2019

Regardless of where the future of cryptocurrency lies, both development and further volatility will certainly fill the future of cryptocurrency. We just have to wait and see. For even more content on cryptocurrencies, check out our Cryptocurrency Section on Robots.net.